About Us

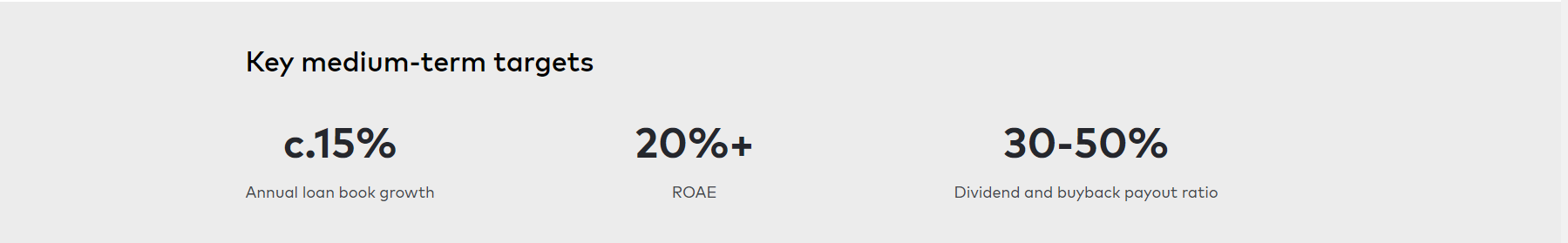

Bank of Georgia Group PLC is a FTSE 250 holding company whose subsidiaries provide banking and financial services focused in the high-growth Georgian and Armenian markets through leading, customer-centric, universal banks – Bank of Georgia in Georgia and Ameriabank in Armenia. By building on our competitive strengths, we are committed to driving business growth, sustaining high profitability, and generating strong returns, while creating opportunities for our stakeholders and making a positive contribution in the communities where we operate.

For more information please visit: Annual Report