Our approach and strategy

We believe in shared success, embracing sustainability to empower our customers, employees and communities. To do business the right way, we adhere to the highest standards of corporate governance and risk management. This helps us minimise the negative impacts we may have, directly or indirectly, on the economy, community and the environment. We recognise that managing ESG risks is crucial for maintaining our financial strength, and we have integrated ESG considerations into all aspects of our business operations.

Latest ESG ratings

As at November 2024, Bank of Georgia Group PLC holds an ESG risk rating of 16.2 from Morningstar Sustainalytics and is assessed to be at low risk of experiencing material financial impacts from ESG factors. In no event the website shall be construed as investment advice or expert opinion as defined by the applicable legislation.

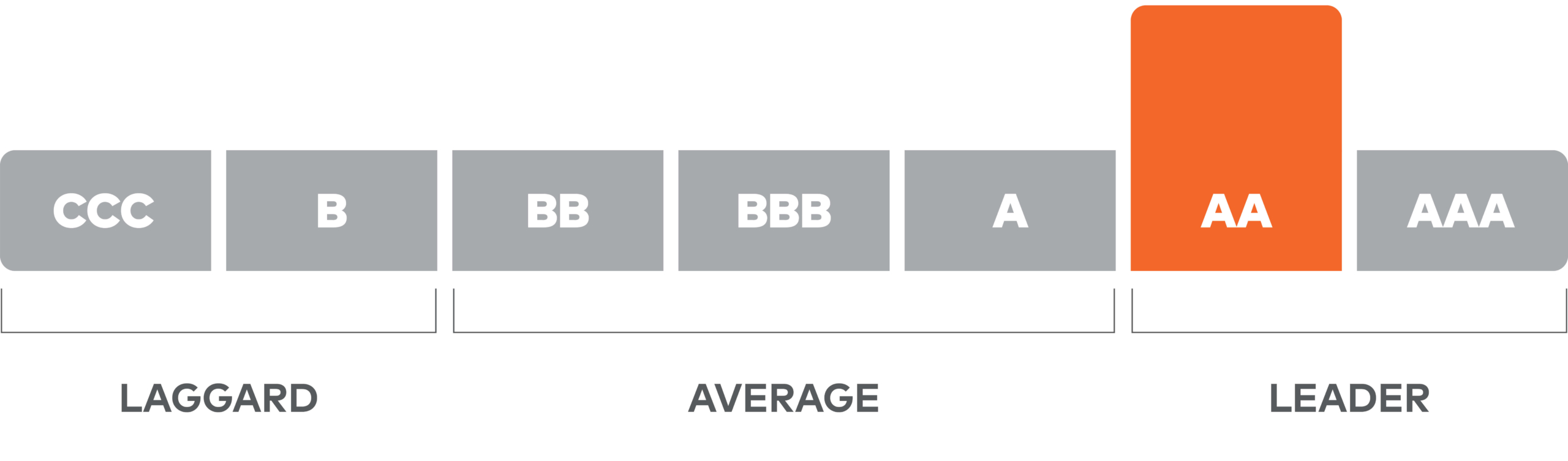

Bank of Georgia falls into the highest scoring range relative to global peers.

As at October 2024

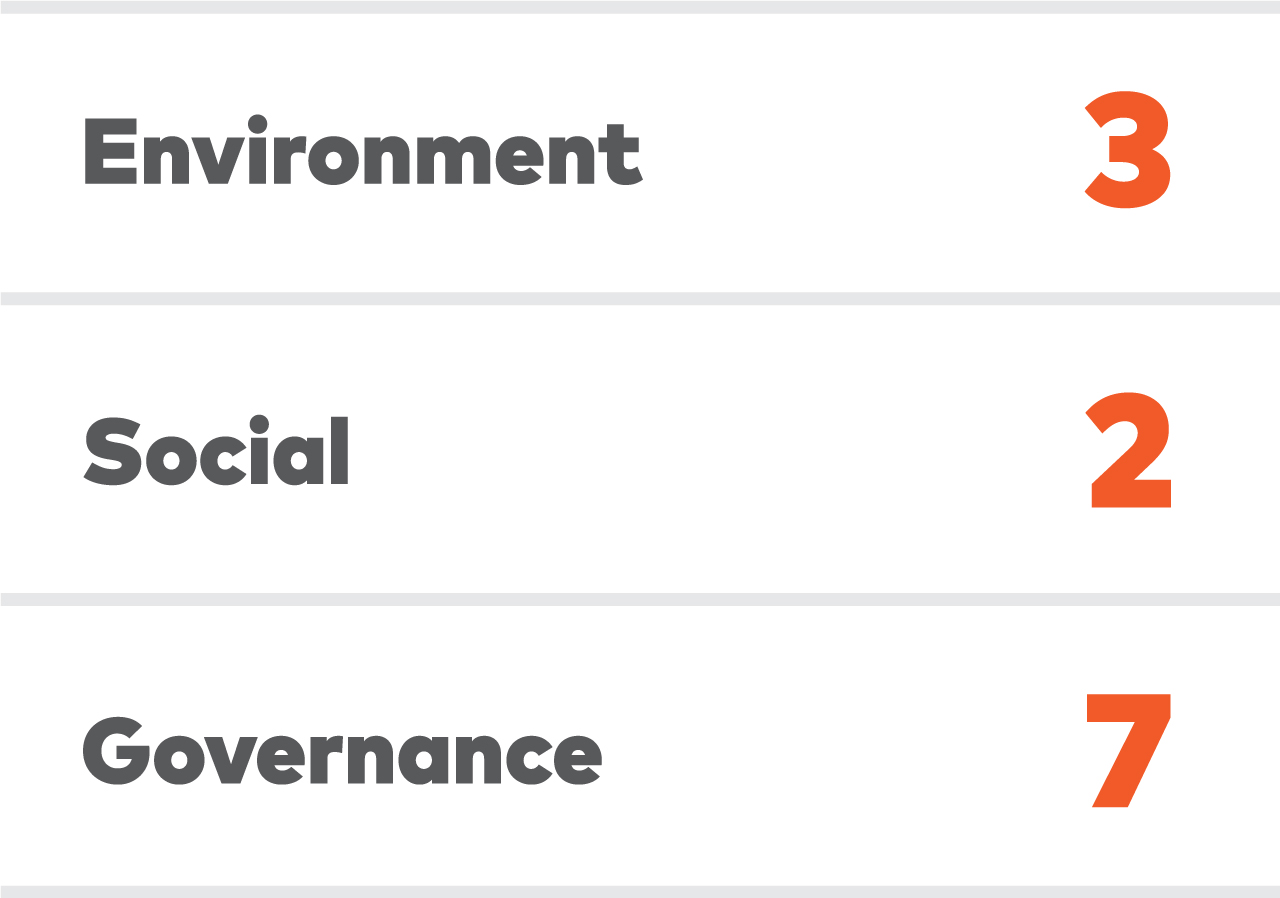

ISS uses 1-10 scale. 1 indicates lower governance risk, while 10 indicates higher governance risk versus its index or region. 1 indicates higher E&S disclosure, while 10 indicates lower E&S disclosure. Scores are as at November 2024.

FTSE Russell (the trading name of FTSE International Limited and Frank Russell Company) confirms that Bank of Georgia Group PLC has been independently assessed according to the FTSE4Good criteria, and has satisfied the requirements to become a constituent of the FTSE4Good Index Series. Created by the global index provider FTSE Russell, the FTSE4Good Index Series is designed to measure the performance of companies demonstrating strong Environmental, Social and Governance (ESG) practices. The FTSE4Good indices are used by a wide variety of market participants to create and assess responsible investment funds and other products.

In 2023, Bank of Georgia Group PLC received a C (‘awareness’), on a scale from A (‘leadership’) to F (‘failure to disclose’).

A CDP score provides a snapshot of a company’s disclosure and environmental performance.