Financial inclusion

Financial inclusion

We believe that improving access to financial services is crucial for enhancing people’s quality of life and fostering economic growth. Financial inclusion is one of our priorities, and we aim to provide accessible financial services and increase financial literacy among the communities where we operate through:

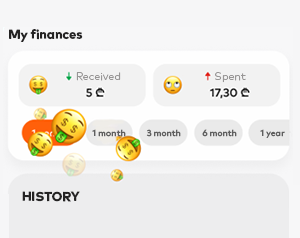

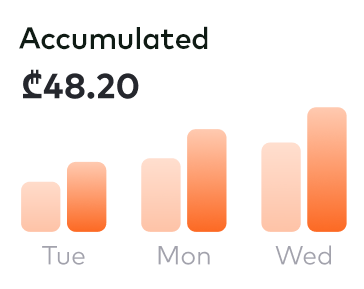

Increasing the use of digital financial products and services

Building financial literacy among young people

Building capabilities of local businesses with relevant tools and information

Increasing the use of digital financial products and services

Through our extensive outreach, we enhance financial literacy via digital content and personal interactions with our customers. Leveraging technology and product innovation, we strive to offer accessible and affordable financial services to everyone.

Customers can access our mobile app’s full functionalities without Wi-Fi or mobile data

Digital onboarding in our mobile app and internet bank

Tutorials and instructions for new digital products are available on our website

Free or low-cost current accounts and debit cards in Georgia

Free product bundles for school and university students and a separate tailored mobile app for school students – sCoolApp

Lower fees on payments acceptance solutions for smaller merchants in Georgia

A wide network of ATM and BOG pay self-service terminals across Georgia

A Web version of BOG Pay terminals – bogpay.ge

How we ensure financial inclusion of our businesses

A critical challenge confronting SMEs in their pursuit of financial support is the absence of robust accounting practices. Bank of Georgia’s Accounting Development Programme is designed to empower SMEs by addressing critical accounting challenges and fostering financial inclusion. Through collaborations with local accounting firms, this programme promotes increased transparency and proper financial management.

We understand that businesses require more than just financial support to succeed. That is why we provide comprehensive strategic advisory services and networking opportunities for our SME clients. Spanning from in-depth market analysis to crafting expansion strategies, we help businesses make informed decisions and overcome challenges. Through our events and platforms, we connect SMEs with partners, suppliers, and customers, fostering collaboration and growth.

Improving accessibility to knowledge for our clients is another of our central commitments, underlining our dedication to enhancing their overall business experience. This commitment involves developing and maintaining a comprehensive knowledge base covering industry trends, market analysis, and best practices. We customise the delivery of this knowledge to meet the unique needs and goals of each client, ensuring relevance to their specific industry and business model.

Bank of Georgia’s Accounting Development programme helps SMEs overcome the hurdle of accessing finance by promoting effective accounting practices. Through its partnerships with local accounting firms, Bank of Georgia provides affordable accounting software packages to help SMEs run their businesses more effectively.

Programme focuses on three areas: comprehensive accounting services, digitalisation and quick financial information sharing. This enables them to fully outsource their accounting practices, gain access to digital tools and automate accounting related processes.

500 +

Bank of Georgia Group PLC initiated the 500 Georgia acceleration programme in 2020, in a strategic partnership with 500 Global and Georgia’s Innovation and Technology Agency (GITA). This collaboration was designed to fast-track the development of both Georgian and international early-stage startups operating in the region. During 2020-2021, 28 companies from 11 business sectors successfully completed the programme and were integrated into the Digital Area ecosystem.

22

63

37